You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin

- Thread starter KeithE

- Start date

Starfox

Masterpiece

Yes, welcome to the financial crisis, sub prime mortgages and baseball cards. The arse really fell out of the latter but the tax payer didn´t have to bail them out at least.

GFT a term coined(pun intended) well before the advent of crypto and explains the fundamental greed of human economics. Basically applies to all asset class transactions so not overly sure what the point is.

Forsoothe!

Imperial Masterpiece

I respectfully disagree that "fundamental" greed is universal. I think the bell curve is operative and the people who get caught with their tits in the ringer are at the extremes.

Starfox

Masterpiece

I didn't say anything about it being universal, although......

Yet it explains why we bounce along from bubble to bubble, time after time whether it be the stock market, real estate or even crypto before the market resets itself. Its the fundamental cycle and makes people with more money than you and I will ever see even more money. GFT is putting a lot of people through retirement.

On that, why a 401K or IRA when you can hodl your money in a relatively safe high interest savings account?

There is that GFT again, someone is always going to pay you more. If you ask me investing money that you will be relying on in any type of casino isn't the greatest of ideas, but each to there own.

I've long thought irony was dead or dying, this thread isn't helping much.

Yet it explains why we bounce along from bubble to bubble, time after time whether it be the stock market, real estate or even crypto before the market resets itself. Its the fundamental cycle and makes people with more money than you and I will ever see even more money. GFT is putting a lot of people through retirement.

On that, why a 401K or IRA when you can hodl your money in a relatively safe high interest savings account?

There is that GFT again, someone is always going to pay you more. If you ask me investing money that you will be relying on in any type of casino isn't the greatest of ideas, but each to there own.

I've long thought irony was dead or dying, this thread isn't helping much.

Forsoothe!

Imperial Masterpiece

Alas and alack, interest bearing accounts are always going either pay just above inflation, which is a loser, or pleasantly higher if you're willing to chance a less safe bond holder. At the moment there is no is decent interest bearing accounts and raging inflation is just over the horizon, so getting locked into a fixed payment bond is suicide. There are never any easy answers. There will always be winners and losers in investment circles and some that seem to always win, but the reality is a crap shoot is always a crap shoot and that black swan can show up at any time, so the middle of the road is safer than the edges and you can make a moderate profit there.

Bonsai Nut

Nuttier than your average Nut

Yet it explains why we bounce along from bubble to bubble, time after time whether it be the stock market, real estate or even crypto before the market resets itself.

I read a fun article a couple of weeks ago that asked successful fund managers their favorite category of investment funds, and over 90% came back with "value" or "growth". The lowest rated category was "cryptocurrency".

There are some very sophisticated people out there who do the hard work to recognize opportunity before the rest of the market does (aka Warren Buffet). They buy investments at a discount versus their true worth. There is another category of investor who is the momentum trader - who watches to see market movement and jumps on the bandwagon hoping to snap up crumbs - assuming that other people buying into the market know what they are doing. When you see all of these worthless articles showing charts and graphs with "resistance points" and "30 day trend lines" those are going to be the momentum traders - since they are trying to analyze the past in order to understand the future - with almost no mention of the business, industry, competition, etc.

The existence of momentum traders inherently causes bubbles, because by their very nature they don't know the value of what they are buying - they are just buying because everyone else is. And the only way they will find the true value is to increase the price well beyond it... and wait for the wave to come crashing down.

Forsoothe!

Imperial Masterpiece

Yes, and the TV et al talking heads are always blabbing about "what to buy now" as though you could recombobulate your portfolio every day, or should. It also assumes that there is some way you could possibly know enough to invest in new categories and industries every day. It takes me a week of rummaging around looking for info on a given company before I'm set to move money, and when that's done I keep it there for a while. Switching from tech's to transports overnight because one is hotter than the other is dizzying just thinking about what you are possibly giving up to jump into a sector with dozens of individual and group possiblities that you would have to study. Or, just take their word for it... which will change tomorrow?

leatherback

The Treedeemer

Just buy what you feel is value for money. Most of my investments stay in place for years. e.g., bought into intell at the end of the year. Now it stays for a few years, hoping that intells next generation chips will push them back into the favours of investors. Been a holder of amazon and google for several years. ANd now moving some money into the medical devices. And of course, last year I added some astrazenica (No, they are NOT a vaccin compagny)

Bonsai Nut

Nuttier than your average Nut

Back in the late 90's, when it became apparent that 3D graphics chips were going to be a thing, I bought stock in all three 3D chip manufacturers. I didn't know who was going to make it big, I just knew one of the three was.Just buy what you feel is value for money. Most of my investments stay in place for years. e.g., bought into intell at the end of the year. Now it stays for a few years, hoping that intells next generation chips will push them back into the favours of investors. Been a holder of amazon and google for several years. ANd now moving some money into the medical devices. And of course, last year I added some astrazenica (No, they are NOT a vaccin compagny)

3DFX went bankrupt in 2002. I lost much of my investment.

ATI was bought by AMD in 2006. I more or less broke even.

I sold my nVidia stock in 2002 after I made a 10x return.

At the end of the day, I made about 4x on my total investment across all 3 stocks, which I was quite happy with.

The sad thing is that nVidia crawled along... sometimes trading for less than $2 a share, until about 2015, when it started to crawl out of the gutter. Today's price is $761 per share. Had I held my stock instead of selling it when I hit 10x, I would instead have made a 463x return

leatherback

The Treedeemer

The sad thing is that nVidia crawled along... sometimes trading for less than $2 a share, until about 2015, when it started to crawl out of the gutter. Today's price is $761 per share. Had I held my stock instead of selling it when I hit 10x, I would instead have made a 463x returnOh well, who can hold a stock for 13 years waiting for it to move somewhere?

Crazy isn't it? How ones perception changes. Fundamentally a good idea to buy stock in company *. Stock has increase value by a factor 10, maybe I should sell. Even if the outlook has not changed. Spring 2020 as the lockdowns were getting serious I added to amazon, even though I was concerned their value had increased a lot already over the years. Now I am looking at around 50% increase. With rumors being that they might start offering medical services I am still hoping they will outperform. But.. Corona seems to be dropping in many places in Europe, with increased vaccination that could start happening in other places too. What will that mean for them. Will they suffer a fallback?

This is why I do not do short term trades. One can predict in broad strokes what direction the world is moving and you can make a best guess as to which type of companies might benefit. Then pick your favourite areas. In fact, I prefer managed funds over singular stocks most of the time. Takes a bit chunk out of the risk (And of the potential ups). But is also takes a lot of worrying and thinking away. There are people making a living out of getting the best picks in a domain.

Bitcoin is like a casino. WIth luck, you make a bundle. However, if you sleep for a few days, you loose it. It is fun, but avoid staying too late.

Starfox

Masterpiece

(aka Warren Buffet)

I try to look at things as objectively as I can and as clever as Buffett is he doesn't know much about cryptocurrencies and has no experience in that part of the market, at least he wont publicly admit it. There is a reason him and his mates on that side of the market don't like cryptos, in fact they vehemently go out of their way to lay the hate down without any facts, they sound like hysterical children whenever crypto is brought up.

Just saying I wouldn't take stock market advice from a crypto expert who wishes to see the downfall of centralised markets so it's unlikely I'll take any cues from people who wish to see the collapse of cryptos either.

In saying that he is a smart man so maybe it is worth looking into what his firm investing into, and it's curious.

They recently dropped 500 million into an obscure Brazilian digital bank that deals with crypto among other things. And they are long term investors in JP Morgan who are one of the companies dabbling with crypto too. If he hates it so much then why is his firm heavily investing in crypto related business(more than just those two as well)?

The answer is blockchain. Which is also partially the answer to why cryptocurrency has value and also why it's going nowhere. But I digress, people are now starting to realise the tremendous potential of blockchain technologies. There has been an huge shift and it is going to fundamentally change the way we do most things digitally. Buffet knows this so is getting in on the second floor because the industry is on the verge of exploding in a very big way. Funnily enough the crypto geeks have been saying this for years, just waiting for the tech to catch up. Certainly some of those cryptos, especially the one in the Ethereum ecosystem have a head start but there are others with their own useful blockchains doing different things as well. Bitcoin itself is not as useful and will probably just be a sort of digital gold but others are developing all the time and it's already out there in the business world.

Those stupid bonsai trees I posted earlier, the NFT technology behind them is impressive and will change the way we do contracts. It's coming, it's more than just digital currencies, the whole crypto ecosystem is about to take off.

Interesting you mention Nvidia too, that price pump has an awful lot to do with the shortages created by miners. Investors in Nvidia have crypto to thank however it is not the end of the story. They have their own blockchain too, you may want to buy back in as 761 might be the lowest you see it again. Mastercard, Amazon, AMD, IBM, PayPal to name a few are all going to benefit from it. If I was in the stock market I would gobble it all up.

It is fun, but avoid staying too late.

You're supposed to hodl. lol

Bonsai Nut

Nuttier than your average Nut

The answer is blockchain.

Blockchain isn't a proprietary technology. It is simply an electronic identification tag with a secure ledger. No one "owns" the idea. You can't invest in blockchain because the idea is public domain and there are zero barriers to adoption or use. There are many potential applications for blockchain - particularly cases where a product's development and/or distribution chain is complicated or insecure. But I could set up my own blockchain here in my house and use my family to maintain it just as a proof of concept and it would cost me next to nothing. Right now it is hyped like nuts... but I think the actual applications will be integrated with big information tech companies like IBM - and their net impact will be minor in aggregate because they will just become part of the value-added information processing services they offer.

Here are simple value benchmarks that Berkshire Hathaway stocks meet:

- Top 25% of all stocks in terms of five-year annual EPS growth rate.

- 15% or greater sustainable growth.

- 12% or better 5-year average return on equity.

The sad thing is that nVidia crawled along... sometimes trading for less than $2 a share, until about 2015, when it started to crawl out of the gutter. Today's price is $761 per share. Had I held my stock instead of selling it when I hit 10x, I would instead have made a 463x returnOh well, who can hold a stock for 13 years waiting for it to move somewhere?

By the way, I might not have mentioned why I am bringing up this example. nVidia didn't become a 463x return in 6 years due to a sudden increase in the demand for PC graphics cards for games. They got that valuation because of bitcoin. nVidia chips (and ATI) are used for mining bitcoin, to such an extent that today it is very difficult to buy a current generation graphics card because they are being bought up to support the bitcoin bubble. If bitcoin truly does implode, short nVidia stock.

Last edited:

Starfox

Masterpiece

Forsoothe!

Imperial Masterpiece

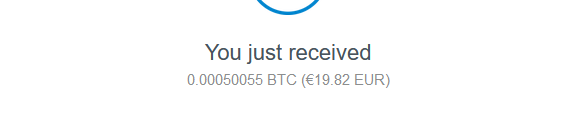

One of the principal ways to suck someone in a Ponzi scheme is The Early Payoff. People are so impressed that they cough up new money that they force on the con-man. Have you ~invested~ other funds into BTC? I'm keeping track of what I consider sage observation by my betters...Not bad for 20 days intermittent mining. Would be double if I ran it 24 hours a day or triple with a better gpu.

View attachment 391655

The market giveth, and the market taketh away. From exactly which pocket is always the rub. I'm making a gentleman's bet that funny money is a likely source of reality.

Njyamadori

Chumono

How much was it in electric bill ? LolNot bad for 20 days intermittent mining. Would be double if I ran it 24 hours a day or triple with a better gpu.

View attachment 391655

Starfox

Masterpiece

Cents, roughly 17 cents for every 2dollars. Microsoft Flight Sim is just as taxing really and with work from home tax offsets it's negligible.How much was it in electric bill ? Lol

There are online calculators that can give you a fair idea.

Gaming consoles use more electricity in the overall state of things.

Last edited:

Joe Dupre'

Masterpiece

I'm basically chicken when it comes to investing. BUT......if I were to buy bitcoin, when my intial investment doubled, the intial investment amount would go into an account with Edward Jones where , I feel confident it would increase slowly but surely. After that, anything made on bitcoin would be pure gravy...........with no thought of losing profit AND my initial investment. That's just old conservative me thinking out loud.

leatherback

The Treedeemer

You just about explained how I played it.I'm basically chicken when it comes to investing. BUT......if I were to buy bitcoin, when my intial investment doubled, the intial investment amount would go into an account with Edward Jones where , I feel confident it would increase slowly but surely. After that, anything made on bitcoin would be pure gravy...........with no thought of losing profit AND my initial investment. That's just old conservative me thinking out loud.

wireme

Masterpiece

I put some investment into crypto for the first time last month.Blockchain isn't a proprietary technology. It is simply an electronic identification tag with a secure ledger. No one "owns" the idea. You can't invest in blockchain because the idea is public domain and there are zero barriers to adoption or use. There are many potential applications for blockchain - particularly cases where a product's development and/or distribution chain is complicated or insecure. But I could set up my own blockchain here in my house and use my family to maintain it just as a proof of concept and it would cost me next to nothing. Right now it is hyped like nuts... but I think the actual applications will be integrated with big information tech companies like IBM - and their net impact will be minor in aggregate because they will just become part of the value-added information processing services they offer.

Here are simple value benchmarks that Berkshire Hathaway stocks meet:

People sometimes bash Berkshire Hathaway for investing in "unexciting" established companies like Bank of America or Coca-Cola. But the results speak for themselves.

- Top 25% of all stocks in terms of five-year annual EPS growth rate.

- 15% or greater sustainable growth.

- 12% or better 5-year average return on equity.

By the way, I might not have mentioned why I am bringing up this example. nVidia didn't become a 463x return in 6 years due to a sudden increase in the demand for PC graphics cards for games. They got that valuation because of bitcoin. nVidia chips (and ATI) are used for mining bitcoin, to such an extent that today it is very difficult to buy a current generation graphics card because they are being bought up to support the bitcoin bubble. If bitcoin truly does implode, short nVidia stock.

hbar. IBM is on the governing council..

I got into hbar through an investment with fobi ai, small cap tech stock that lead me to research the coupon bureau, universal digital coupons and that lead to hbar. Dunno where it will go but there will surely be a whole lot of transactions on the ledger. Hopefully many of them through fobi as well.

Bosco Seitzer

Sapling

You can't invest in blockchain because the idea is public domain and there are zero barriers to adoption or use. There are many potential applications for blockchain - particularly cases where a product's development and/or distribution chain is complicated or insecure. But I could set up my own blockchain here in my house and use my family to maintain it just as a proof of concept and it would cost me next to nothing.

Thats what we could do in 2015, now we have NFT's, ERC's and trustless smart-contracts personally, I personally like the idea of using it as secured capital on loans, borrowing against your resources while keeping it whole and free to appreciate in value. Crypto and blockchains allow any individual to be the president of their own financial institution, recently a relative was going on a long trip to visit Ghana with a larger group but had a lot of trouble making a payment for lodging because it had to go through multiple payment providers (ie; Western union). It was a couple of days before it was known that payment had been recieved and not lost, taxed unfairly or stolen by any entity involved.

With any international transaction you have to deal with at least two financial institutions and the beauracracies, possible incompatibilities, and exchange rates. With Crypto you eliminate the need for some pencil-necked manager at your brick and mortar bank that he cannot fulfil your request.

I put some investment into crypto for the first time last month.

hbar. IBM is on the governing council..

I got into hbar through an investment with fobi ai, small cap tech stock that lead me to research the coupon bureau, universal digital coupons and that lead to hbar. Dunno where it will go but there will surely be a whole lot of transactions on the ledger. Hopefully many of them through fobi as well.

With altcoins you really have to compare their performance vs. BTC, just like averaging a stock vs the S& P 500, you will notice that altcoin prices are inexorably linked to BTC. Take hbar for example, 10 billion coins were created already with a max of 50b its not decentralized so the primary stakeholders can potentially just make more when they are done selling off their organization's coins taking the investor money out (called a rug-pull) over and over. It so far seems almost identical to Ripple or XRP which was a project started by some of the largest banks in the US so they would have their own tool to handle long payments, it hasnt been a profitable investment for investors because the owners sold 10s of millions of dollars of coins frequently... whenever the price was high enough.

oh and why are the prices of Bitcoin, altcoins, and shitcoins linked? Because when they crash their coins value by selling off their stake they use the money to buy BTC.

Crypto is not a stock holding it does not make you a shareholder, large IBM sized corporations know they have to produce shareholder profits and they have one way to do it.